Should You Keep or Sell Vested RSUs

While the stock price of my employer has gone up multiple folds since IPO and the trend may continue for some time, I recently decided to sell the RSUs once they are vested. Yestoday, I came across this blog, which suggests that my decision does make sense. If you are also considering what to do with your vested RSUs, I'd highly recommend you have a look at this article as well. Although different your choice might be, understanding the underlying logic and making your decision a well informed one should be beneficial.

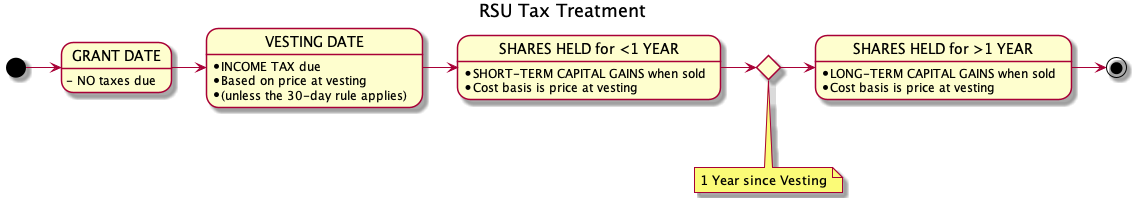

To summarize, since RSUs are taxed on the dates when they are vested, keeping all the vested RSUs is like buying these RSUs using all cash bonus. Actually, it more than that: you need to set aside extra money to pay the tax incurred. With that in mind, it becomes interesting seeing many people choose to keep all vested RSUs while they wouldn't spend all cash bonus before tax to buy company shares should they are given cash bonus. This reason of this behaviour can be described as cognitive dissonance caused by regret aversion.

Having said that, it is totally legit to keep some or all the vested RSUs based on the outlook for the company. But, please keep in mind that even all vested RSUs are sold you still have your long term position: RSUs not vested yet.

blog comments powered by Disqus